Everything about Wyhy

Wiki Article

The Basic Principles Of Wyhy

Table of ContentsWyhy Can Be Fun For AnyoneWyhy for DummiesGetting The Wyhy To WorkSome Known Incorrect Statements About Wyhy Getting The Wyhy To WorkThe Buzz on Wyhy

They'll desire to see that the price you're paying is a practical appraisal of the watercraft; new boats will generally provide less issues for a lending institution than a used boat that might be valued beyond what the marketplace might bear. If there is an inquiry regarding the worth of a used boat and you're eager to take down enough cash to decrease the loan provider's threat, that concern may be adequately solved.When deciding where to get your boat financing, 2 major alternatives are banks and cooperative credit union. There are plenty of benefits when you select to finance the boat at a lending institution, which is a not-for-profit monetary cooperative that's been developed to profit its members and improve their monetary health.

Some Of Wyhy

To obtain a watercraft financing with SCCU, you simply need to reside in Florida and register your boat in the state of Florida. See our five-minute overview to getting a boat.interest ratesfor watercraft loans are generally reduced than those at a bankfees are normally loweras a member, you: often receiver far better rates of interest for car loans will obtain a lot more customized solution, which can consist of monetary educationhave the opportunity to sustain your communitywill typically receive a greater passion rates on interest-bearing accounts, certifications, and much more, making a credit history union subscription a win/winSCCU offers even more than 500,000 participants in these areas along the east shore of Florida with 60+ branch locations from Flagler to Miami-Dade counties.The electronic closing process is quick and simple (or you can shut at the branch nearest you), and we also provide totally free Online and Mobile Banking for the best in comfort. If you have inquiries, simply call the branch nearest you:321 -752 -2222954 -704 -5000305 -882 -5000800 -447 -7228 We have affordable funding programs for the watercraft of your desires!.

The 6-Minute Rule for Wyhy

Price quote just how a lot a month-to-month watercraft financing settlement will certainly set you back and establish if you can manage it. There are lots of wonderful alternatives for watercraft financing suppliers, yet doing your research study first is critical.

Wyhy - An Overview

If it's in the upper 600 range, you should not have an issue obtaining financing, but you may get charged extra on the interest price. Scores reduced than that can come to be troublesome, so check your credit history score.Financing can aid you preserve liquidity, however much more notably, it may additionally assist you purchase a more expensive boat that may or else appear out of reach - wyoming credit union. Boat loans made use of to be a lot more restricted in period, and now typical watercraft loan terms of 10 to 20 years are basic. Rate of interest prices are very low, and the deposits required nowadays can range anywhere from no money to 20 percent

This guide covers exactly how to secure financing for a boat, regardless of your credit history circumstance or the boat you pick to purchase. If you have cost savings, you may be asking yourself if you ought to trouble funding a watercraft or if you can discover a cheaper choice to buy with cash money. While you may not have to bother with handling a financing or making regular monthly repayments, there aren't many benefits to getting a boat in cash money over safeguarding a finance.

Some Known Details About Wyhy

Both these procedures can come Full Article to be very complicated, so it is smart to collaborate with a financing specialist to guide you with the process. When buying a watercraft, recognizing exactly how to finance your acquisition is important. For several watercraft customers, a large, lump-sum acquisition isn't possible. Though you might have some savings for a down repayment, you may wish to obtain a loan to cover the continuing to be expense. https://fliphtml5.com/homepage/earpm/johncole2312/.

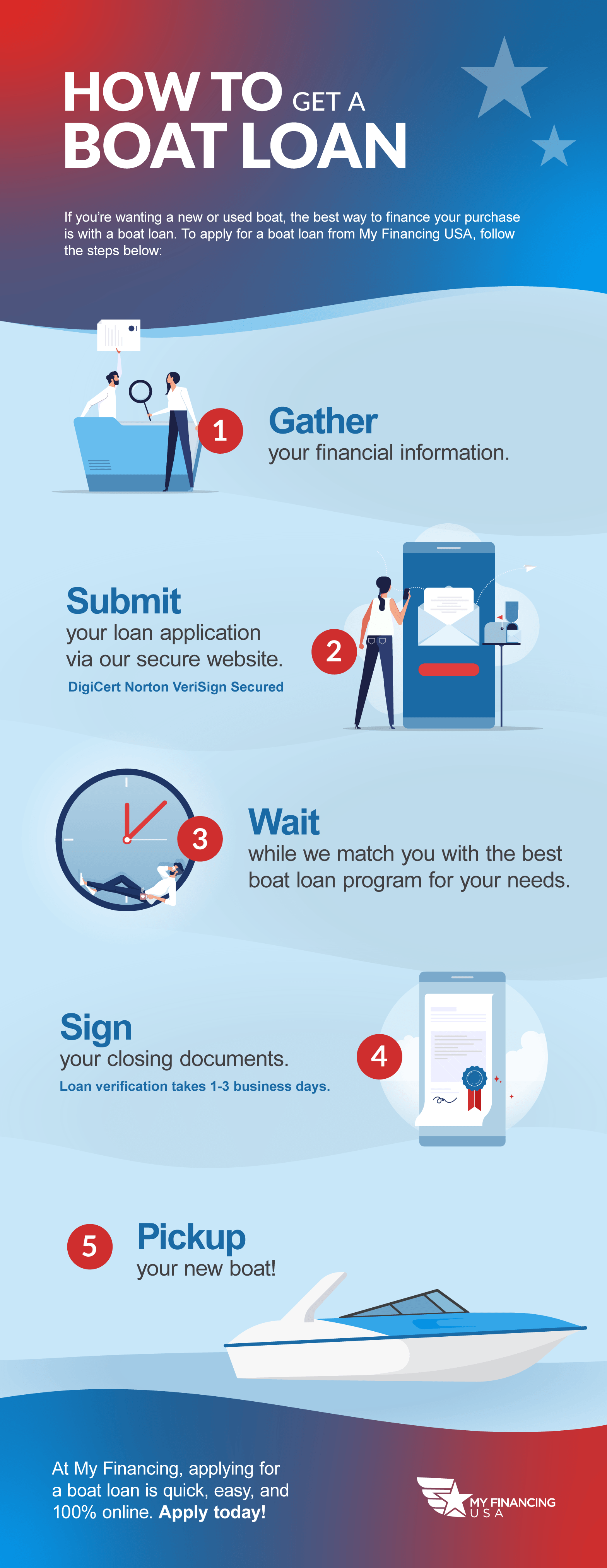

At My Financing U.S.A., we provide better-than-average boat funding. Our interest rates for watercraft fundings are Rates Between 6.49% and 19.95% depending upon your area, credit report background, kind of boat you are financing and the quantity you are funding. Use our watercraft lending repayment calculator to establish what month-to-month payment you may be able to pay for.

The Definitive Guide to Wyhy

However, this impact is usually minor and temporary. Connect to an expert credit rating consultant with any inquiries or problems. The prices and terms you may be able to obtain differ from loan provider to lender. Contrast the loan providers by reviewing your alternatives with them and meticulously reviewing the small print, which will have details on the financing's length, what minimum credit history you must have and whether there are limitations on your boat's age.Rate of interest rates are an essential factor to consider, as they can significantly affect how much you pay complete over the funding period. It is crucial to guarantee you are comparing passion prices for the same loan kinds.

Report this wiki page